does texas have a death tax

There is a Federal estate tax that applies to estates worth more than 117 million. The top estate tax rate is 16 percent exemption threshold.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The federal estate tax disappears in 2010.

. Critics have dubbed it. No there is currently also no inheritance tax in Texas for individuals who died on or after January 1 2005. Tucked away in Bidens American Families Plan is a revision to the way capital gains taxes are paid on estates when people die.

Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022. It only applies to estates that reach a. Does every state impose a death tax.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. There is a 40 percent federal tax however on estates over 534 million in value. En español Most people dont have to worry about the federal estate tax which excludes up to 117 million for individuals and 234 million for married couples in 2021 up from 1158 million and 2316 million respectively for the 2020 tax year.

Prior to September 15 2015 the tax was tied to the federal state death tax credit. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million. Understanding how Texas estate tax laws apply to your particular situation is critical.

Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. Death Taxes in Texas.

Also good news over 90 percent of all Texas estates are exempt from federal estate taxes. New death sentences in Texas have decreased since peaking in 1999 when juries sentenced 48 people to death. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive.

Does Texas have a death tax on one that has died. Does Texas have an inheritance tax. Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property.

There were no jury rejections of the death penalty in the small. No estate tax or inheritance tax. The Texas Tax Code Section 3306 allows taxpayers 65 years of age or older and homeowners with disabilities to defer property taxes on their primary residence homesteadBut what does that really mean.

For individuals who passed away between September 1 1983 and January 1 2005 a Texas Inheritance Tax Return must be filed. Six additional states also levy an inheritance tax. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs.

The beneficiaryies should complete and file the claim forms and related documents before the first anniversary of the death of the member to avoid adverse tax consequences. Death sentences have remained in the single digits for the past six years. There is a 40 percent federal tax however on estates over 534 million in value.

While Texas does not impose a state inheritance or estate tax if you die without a will your assets will be distributed through the states intestate succession process. Are the taxes waived. What Is the Estate Tax.

Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on Sept. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. UT ST 59-11-102.

The top estate tax rate is 20 percent exemption threshold. Tax is tied to federal state death tax credit. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

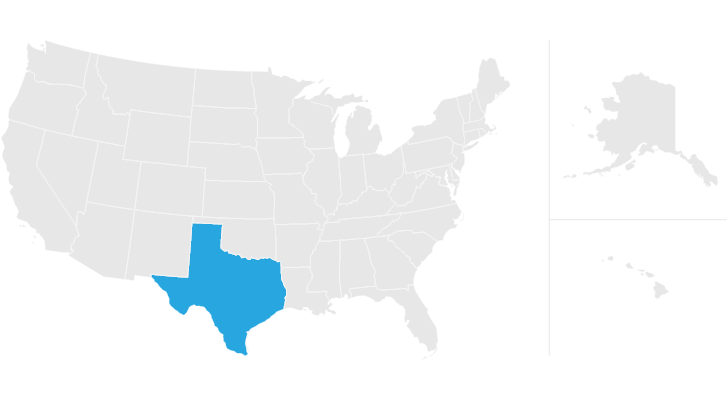

No Texas does not have an estate tax for the time being anyway. No estate tax or inheritance tax. Texas does not levy an estate tax.

No not every state imposes a death tax. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. Intestate succession laws affect only assets that are typically covered in a will specifically assets that you own alone like real estate stock market investments businesses and other types of physical.

Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. No estate tax or inheritance tax. Do you have to pay estate tax in Texas.

Only 12 states plus the District of Columbia impose an estate tax. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. It is one of 38 states with no estate tax.

If you have an estate that is big enough. No the taxes are not waived. They dont go away.

This means that an estate might be required to pay both federal. The tax deferral simply delays when the tax has to be paid. When TRS receives all properly completed documents the claim.

There is a 40 percent federal tax however on estates over 534 million in value. No estate tax or inheritance tax. Federal estate taxes do not apply to most people.

Texas State Taxes Forbes Advisor

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do Property Taxes In Texas Work Houston Texas Texas Property Tax

Pin By Kay Reeves On My Death Book Estate Planning Checklist Funeral Planning Funeral Planning Checklist

The Ultimate Estate Planning Checklist Asecurelife Com Estate Planning Checklist Estate Planning Funeral Planning Checklist

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Talking Taxes Estate Tax Texas Agriculture Law

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Who Is Eligible For Texas Medicaid In Order To Qualify For This Benefit Program You Must Be A Resident Of The Health Care Insurance Benefit Program Medicaid

Who Can Put A Lien On Your House In Texas Texas Homes Texas County Tax Protest

Como Puedo Probar La Herencia En Texas Tax Protest Protest Property Tax

What Happens If A Heir Does Not Sign For Probate If You Refuse To Agree To The Final Report And Distribution Of The W Republic Of Texas Probate The Hamptons

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs